✕

MEV-resistant cross-chain swaps and multichain issuance.

OVERVIEW

Velodrome embedded Hyperlane deep in the infrastructure powering their cross-chain DEX. Hyperlane’s open and permissionless model made them confident about maintaining protocol sovereignty while relying on Hyperlane to unlock core DEX functionality including MEV-resistant cross-chain swaps, liquidity allocation, and emissions management.

75,000

Liquidity-Allocation Votes

Velodrome constantly optimizes liquidity across chains via Hyperlane cross-chain voting messages (data as of August 2025)

30,000

Monthly Messages

Velodrome uses general message passing for liquidity allocation votes, and Hyperlane Warp Route (HWR) messages to facilitate cross-chain swaps

31

Seconds

Median transaction settlement latency, with near perfect fill-rates (unlike intent/solver-based liquidity)

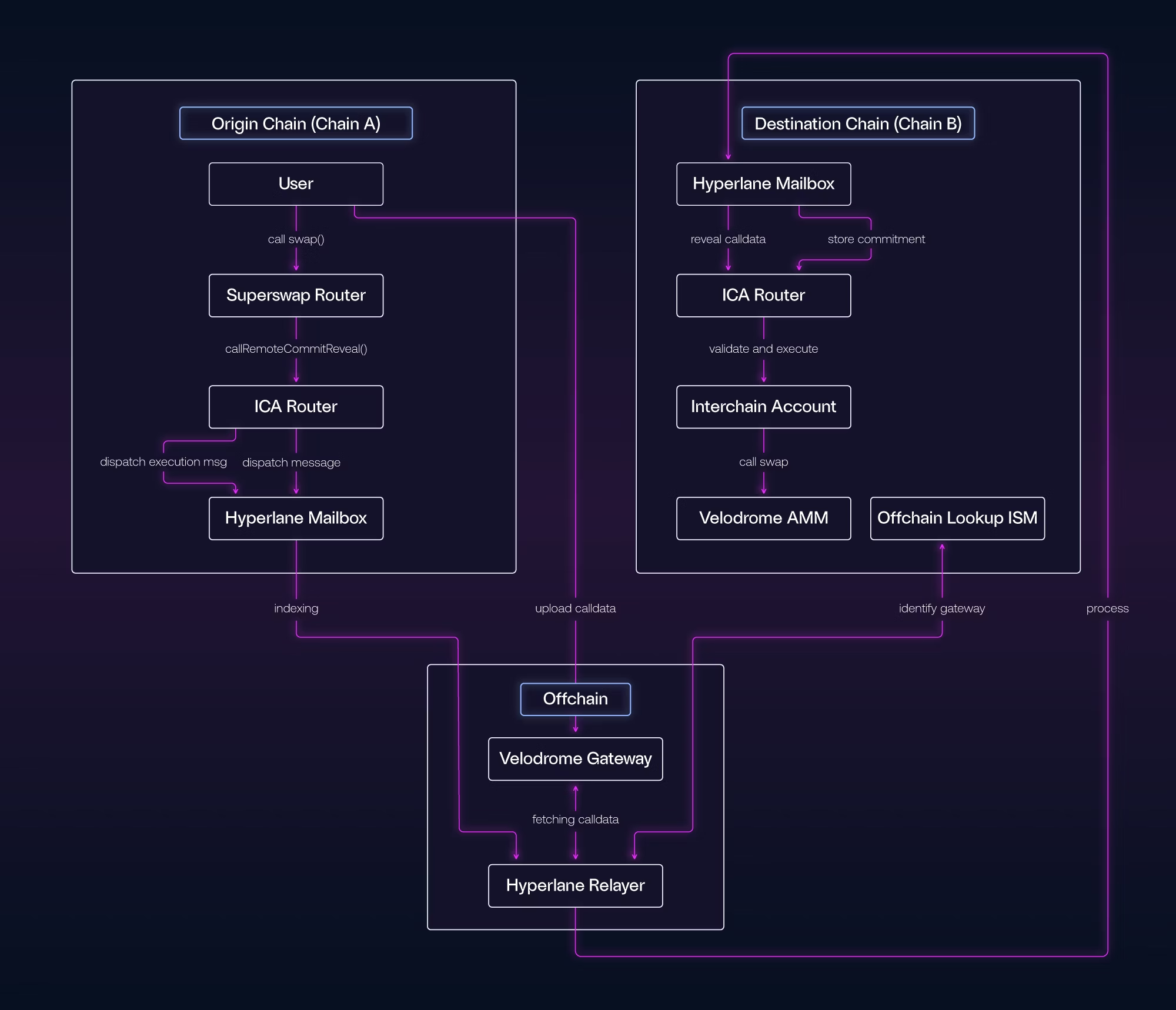

Velodrome MEV-resistant swap architecture

Velodrome layered multiple Hyperlane features to build one-click cross-chain “Superswaps,” leaning heavily on Hyperlane’s modular and extensible design. Interchain Accounts to manage execution across multiple chains, a custom ISM for MEV protection, and Hyperlane Warp Routes (HWR) for cross-chain routing.

THE DETAILS

The challenge

Velodrome, the largest DEX on the Optimism Superchain, needed an interoperability solution to grow market share via access to users across numerous chains, support more pairs to increase volume, and improve execution with deeper liquidity. As a cross-chain DEX, interoperability across chains is core to Velodrome's design, and the team required infrastructure that was fully open and permissionless, to maintain sovreigntey over their product.

At a feature level, they wanted to increase coverage and flows by enabling pairs requiring routes across chains, improve liquidity and fill rates by optimizing LP allocations across pools in various L2s, and MEV-protect swaps for better execution quality. Ideally, all this would be accomplished with simple one-click UI/UX for both traders swapping assets, and LPs allocating emissions across chains.

What we did

Hyperlane is open, modular, and extensible by design, and Velodrome stacks numerous features in their implementation. For traders, they enable coverage of all cross-chain routes using OpenUSDT, a Hyperlane-optimized version of Tether USDT, as an intermediate settlement asset bridged through Hyperlane Warp Routes (HWR). Interchain Accounts trigger destination-chain calls from within the initial origin-chain transaction, making for a seamless, one-click experience, while a custom Interchain Security Module (ISM) obscures swap data until final execution, to MEV-protect trades.

On the maker side of the market, Velodrome uses Hyperlane General Message Passing (GMP) to make their veVELO-based liquidity allocation mechanism function across multiple chains. Stakers allocate emissions to any Velodrome-supported chain, and these calls for VELO issuance direct VELO tokens cross-chain via Hyperlane Warp Routes (HWR). This functionality works well because VELO is issued as a Hyperlane Warp Asset (HWA), part of Hyperlane's multi-chain framework for asset issuance.

Most importantly for Velodrome, all of this functionality is part of Hyperlane's framework, which is free to deploy across 130+ chains, including the full Superchain ecosystem. This means Velodrome comfortably embedded Hyperlane infastructure deep in their protocol mechanisms, without risk to protocol sovreignty or being subject to future rent-seeking. They rely only on the protocol's agent relayers and economic security, both of which can be leveraged directly by Velodrome without a third-party dependency.

Outcome

Velodrome's cross-chain Superswaps are live with seamless MEV-resistant cross-chain trading among nine chains, one-signature transactions for superior UI/UX, and smooth liquidity allocation across chains. Tens of thousands of cross-chain messages reliably run through Hyperlane each month supporting billions of Velodrome swap volume.

Let's build together.

Get in touch to launch your bridge, asset, exchange or other app with interoperability across EVM, SVM, Cosmos, and more.

Read More

Read more Hyperlane

Use Case Stories